Worthune’s comprehensive and in-depth guide to Donor Advised Funds (or D.A.F.s) helps wealthy families understand the new and hot concept in charitable giving spanning areas like how a Donor-Advised fund works, what are the pros and cons of a donor-advised fund, the tax implications, and a brief overview of the various sponsoring organizations.

Donor Advised Funds – A Comprehensive Guide to DAFs:

Content Outline

What is a Donor Advised Fund?

How does a Donor Advised Fund work?

What are the Tax Benefits of a Donor Advised Fund?

How popular are the Donor Advised Funds?

Why are some Charitable Organizations and advocates concerned about Donor Advised Funds?

What are the disadvantages of a Donor Advised Fund?

What other options do I have for philanthropy and charitable giving?

Who are the top sponsors of Donor-advised Funds?

Which Charity can I pick to give grants from my donor-advised fund?

Let’s dive deep into the concepts and inner workings of donor-advised funds.

[ps2id id=’link1′ target=”/]

What is a Donor Advised Fund? A Simple Definition with Complex Underpinnings

A donor-advised fund is a charitable investment account set up by a grantor, who receives current tax benefits, at a sponsoring organization for charitable giving and an ability to direct grants and choose charities.

Let’s unpack this definition of a Donor Advised Fund and make it a bit clear. A grantor is an investor who sets up the DAF account. It is a charitable investment account which means the funds in the account can grow. The grantor can receive current tax deductions for their contribution to the donor-advised fund. The purpose is to give the money in the donor-advised fund account to charity. A sponsoring organization is a public charity. The funds in the account are typically invested in various options. The donor can recommend grants from the account over time to various charitable organizations.

[ps2id id=’link2′ target=”/]

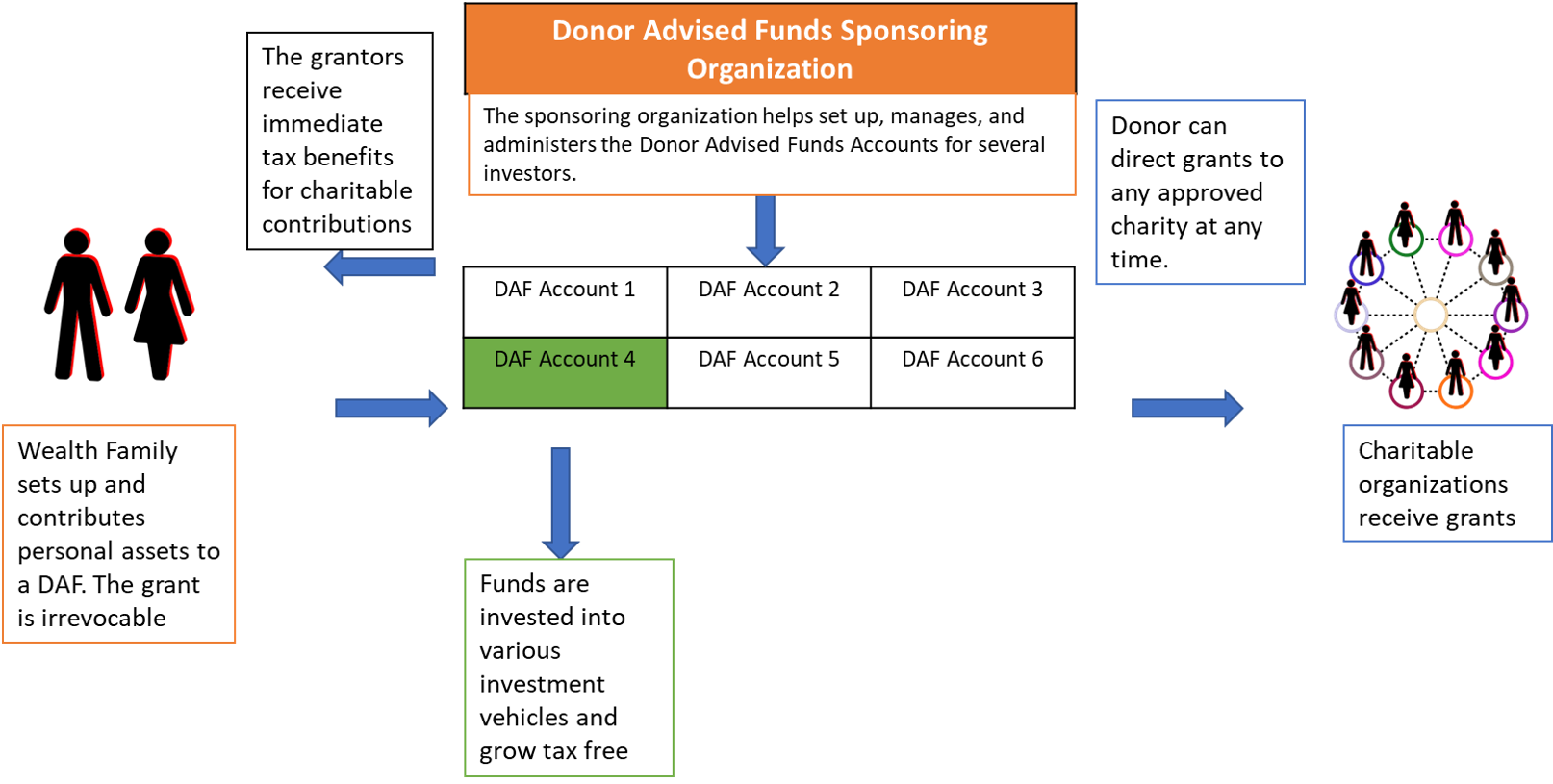

How does a Donor Advised Fund work?

The essential reasons for the recent popularity of Donor Advised Funds are its relative simplicity to set up and operate, the immediate benefits that flow through to the grantor, and the feeling of control a DAF account offers. Let’s look at how donor-advised funds work step-by-step.

- An investor sets up a donor-advised fund with a sponsoring organization.

- The investor makes an irrevocable contribution of assets to the fund. Typically, these are highly appreciated securities and illiquid assets.

- The investor/donor gets to choose the account name and also name the successors, advisors, trustees, beneficiaries. Any of the not-for-profit enterprises are eligible, but sometimes the sponsoring organizations may limit who is on the list.

- The investor/donor/grantor receives an immediate tax benefit for charitable contributions. (These are subject to general guidelines and limits of the IRS (Internal Revenue Service.)

- The sponsoring organization administers the funds in the account and making grants.

- The assets in the donor-advised fund may be invested into various growth avenues. (Generally, financial institutions that act as the sponsoring organization offer their own funds as options.)

- The assets can grow tax-free

- The donor/grantor can recommend grants to any of the approved charitable organizations.

A visual depiction of how Donor Advised Funds work?

[ps2id id=’link3′ target=”/]

What are the Tax Benefits of Donor Advised Funds?

While ultimately philanthropic and charitable intent should drive the set up of Donor Advised Funds, for wealthy investors who are tax-smart, there are several tax benefits which can help the cause. (As always it is wise to look up latest IRS rules and regulations as they may change plus consult your legal and tax advisors.)

Income Tax Benefits for Grantors of Donor Advised Funds:

Grantors who set up a DAF account at a public charity and irrevocably contribute personal assets to donor-advised funds are eligible to receive an immediate income tax deduction in their current tax year.

The current limitations for the extent of charitable deductions to a DAF account are:

Deduction for Cash Assets – 60% of the Adjusted Gross Income

Deduction for Appreciated Assets and Market Securities – 30% of the Adjusted Gross Income

IRS allows a 5-year carry forward for unused deductions

Capital Gains Tax Benefits for Grantors of Donor Advised Funds:

For any of the contributions to a donor-advised fund, the investor does not incur Capital Gains. The provision of no capital gains on donated assets is a primary driver for wealthy investors/families to give highly appreciated assets to a DAF account.

Estate Tax Implications for Grantors to Donor Advised Fund Accounts:

Since the grant to a donor-advised fund is an irrevocable charitable contribution, the assets are deemed outside of the grantor’s estate and hence not subject to an Estate or Gift Tax.

Tax Treatment of Growth inside a Donor Advised Fund:

The assets inside a donor-advised fund grow tax-free and hence the power of compounding impacts the entire corpus without the tax authorities claiming a piece.

Alternative Minimum Tax Implications for Donor Advised Funds:

While the Alternative Minimum Tax rules are complicated, it may be possible that the contributions to a DAF account may reduce the AMT impact.

[ps2id id=’link4′ target=”/]

How popular are the Donor Advised Funds?

While Congressional statute (the Tax Reform Act of 1969) went into effect a few decades later, the credit for pioneering a donor-advised fund goes to The New York Community Trust in the early 1930s on behalf of an investor – William Barstow.

“550,000 Americans become entrepreneurs every month,1” said Pamela Norley, president of Fidelity Charitable. “The sheer size of this group, coupled with an expressed interest in having a positive social impact, means they have a tremendous influence on the philanthropic sector.”

According to National Philanthropic Trust, as of the year-end 2016, there are 285,000 individual donor-advised funds across the United States. The donor contributions are over $23 billion, and the total AUM (Assets under management) was over $85 billion. The NPT claims that DAF contributions represent 3% of the charitable donations in the country.

While the DAF accounts are not huge in comparison to the overall charitable donations, the popularity, and frequency of usage of such concepts is growing in popularity.

[ps2id id=’link5′ target=”/]

Why are some Charitable Organizations and Advocates concerned about Donor Advised Funds?

There is a concern among philanthropic advocates and analysts that donor-advised funds are a taxpayer-funded loophole benefiting the ultra-wealthy. The New York Times uses Nicholas Woodman, the founder of GoPro as a case study against Donor Advised Funds to illustrate that despite immediate tax benefits for the Woodmans’, several years later not much of the assets have been granted to any charitable organizations, except an event at an elementary school.

A Bloomberg report calls the DAFs Black-Box Charities and indicates how low payouts and large financial services firms footprint is a significant negative.

The Institute for Policy Studies has come out with a scathing study calling the concept of donor-advised funds as a “Warehousing of Wealth.”

“The world of philanthropy is becoming less transparent, and that’s not a good thing. Recent years have seen the rapid growth of a shadow giving system that funnels billions of dollars in gifts in ways that leave no fingerprints.” – David Callahan, author of “The Givers,”

The critics of the Donor Advised Funds point out the following pitfalls:

- The charity dollars may not flow to the struggling not-for-profit institutions immediately delaying the impact of the charitable dollars.

- Even as the donor receives a full deduction on their current market value of assets, there is no guarantee the assets will retain their value.

- The payout rates from the Donor Advised Funds are meager. Perhaps this is because IRS requires Private Foundations to grant at least 5% payouts, whereas there is presently no such provision governing Donor Advised

- DAFs have no transparency and accountability requirements thus making them opaque.

- While the assets are irrevocable, the donor still seems to be in charge and control of DAFs.

- The sponsoring organizations, while setting up as charitable funds, have deep links to their corporate parents and hence work to further their interests.

Of course, proponents will dismiss these criticisms of Donor Advised Funds as nothing but unfair criticism. We believe the truth lies somewhere in between. While a grantor should consider and weigh tax benefits as a part of an overall estate plan, the primary driver for giving should be “Giving.” We believe some modifications to the IRS rules may benefit the entire sector.

[ps2id id=’link6′ target=”/]

What are the Disadvantages of a Donor Advised Fund?

Donors have no control: Technically, the contribution to a donor-advised fund is an irrevocable donation, and hence the grantor does not have legal power. While they can “advise,” the control is typical with the public charity (the sponsoring organization.)

High Fee and Costs: Given the structure of donor-advised funds and the investment vehicles underlying the funds, the administrative costs, and management fee can take a cut out of the donor-advised funds. This fee is in addition to the expenses incurred by the charities which receive the donation. In particular, some firms pay commission on these assets which brings up several legal and ethical issues.

Delayed Benefits to Not-for-Profits: Given that there are no payout requirements, the payout rates tend to be lower in Donor Advised Funds and consequently it leads to underfunding of the clear and present problems of the society. This lack of immediacy of impact is a leading concern.

Donor Advised Funds are not perpetual agents for change: A private foundation can be an institution for good and live on forever in perpetuity to further its goals. On the other hand, the donor-advised funds are not set up as such.

[ps2id id=’link7′ target=”/]

What other options do I have for philanthropy and charitable giving?

If you are an HNW or UHNW (High Net Worth or Ultra High Net Worth) investor or family, you have several options:

Set up a Private Foundation: One can set up a private foundation to reflect the causes and goals of the grantor.

Set up a Trust: One can set up a Charitable Remainder Trust and benefit charities as well as heirs. (The two leading structures CLAT (Charitable Lead Annuity Trust) and CRUT (Charitable Remainder Unit Trust) accomplish different objectives with regards to who receives the corpus and who receives the income.

Donate Directly: Donating to charities directly without an intermediate structure and constraints may sometimes be the best idea.

“Donor advised funds are not a bad thing. People have irrevocably given money away to charity. Most often they are wanting to give money away to things that are meaningful to them and make a difference,” – Karey Dye, president of the Goldman Sachs Philanthropy Fund

What types of assets can one contribute to a Donor Advised Fund?

Please check with the charitable sponsor for specific types of assets that a fund will accept, but in general, these are the type of assets a donor can contribute to a donor-advised fund.

- Cash or equivalents

- Marketable securities including stocks, bonds, mutual fund shares

- Stock in companies including Restricted and Controlled stock

- Stock in private companies

- Real estate

- Life insurance policy proceeds

- Grants from Private foundations

- Legacy bequests

- From charitable remainder trusts

- Beneficiaries an IRA, 401(k), or another retirement account

- Tangible personal property

[ps2id id=’link8′ target=”/]

Who are the top sponsors of Donor-advised Funds?

The following are some of the top sponsors of donor-advised funds. The listing below is not a ranking or an exhaustive list of available sponsoring public charities. In addition to the fees below, firms may also charge a fee for grants, particularly grants to overseas non-profit entities. Please check with the firms and read the legal disclosures carefully before deciding to open a DAF account.

Fidelity Investments:

Fidelity Charitable Giving Account is the donor-advised fund offered by the financial giant Fidelity Investments.

Minimum Investment: $5,000

Administrative Fee: $100 or 0.06%

Investment Fee: 0.15% to 1.15%.

Charles Schwab:

Schwab Charitable is a public charity that sponsors donor-advised funds.

Core Account:

Minimum Investment: $5,000

Administrative Fee: $100 or 0.06% (whichever is greater

Investment Fee: varies based on the underlying funds but ranges from 0.43% to 0.99%.

Note: Charles Schwab also offers a professionally managed account.

Standard Account:

Minimum Investment: $25,000

Administrative Fee: 0.06%

Investment Fee: varies based on the underlying funds but the range starts at 0.09%

[ps2id id=’link9′ target=”/]

Which Charity can I pick to give grants from my donor-advised fund?

Most sponsoring organizations allow grants to a wide range of public and private charities that are approved by the IRS as a registered charitable organization.

Fidelity allows grants to any IRS approved charities. Click here to find the list of charities Fidelity Charitable allows.

Schwab also allows grants to any IRS approved charities. Click here to find the list of charities Schwab Charitable allows:

Vanguard will enable donations to any IRS approved charities. Click here to see the list of charities Vanguard allows:

For finding the right charity and conducting due diligence, here are a few organizations you can rely on:

IRS Tax Exempt Organization Finder

Disclaimers:

Donor Advised Funds – A Comprehensive Guide is for informational purpose only. Without knowing your situation, we cannot recommend any strategy or vehicle or provider. Please consult your financial, tax, and legal advisors regarding the applicability of a Donor Advised Fund as a part of your overall estate planning strategy and the appropriate corpus and other details. While we strive to provide accurate and up to date information, we cannot guarantee either.

Leave A Comment