Worthune’s Ultimate Variable Annuity Guide for Wealth Investors addresses the often controversial and a complex investment plus insurance vehicle – the Variable Annuities. The industry is rife with debates between various quarters with a vested interest – each espousing their point of view. We are not going to take sides.

Worthune’s Ultimate Variable Annuity Guide for Wealth Investors addresses the often controversial and a complex investment plus insurance vehicle – the Variable Annuities. The industry is rife with debates between various quarters with a vested interest – each espousing their point of view. We are not going to take sides.

The Variable Annuity Guide for Wealthy Investors is not for or against the concept of variable annuities and we, at Worthune, believe that there are time, place, and circumstances in which any investment or insurance product may be appropriate. And same is true with variable annuities.

However, in our belief proponents often hype variable annuities as a swiss army knife and a panacea for various ills that ail the post-retirement phase of life. The opponents, on the other hand, swear that annuities are a fee-chomping beast that is at best a way for brokers, insurance agents, and financial advisors to line their pockets with little or limited value to investors.

The truth, as you might guess, is somewhere in the middle and we believe it is different strokes for different folks.

Now that we have made our stance known about annuities let’s objectively examine Variable Annuities from multiple perspectives. We will let the HWN (High Net Worth) families make an informed decision.

The Ultimate Variable Annuity Guide – Content Outline:

What is an Annuity?

What are different types of Annuities?

What is a Variable Annuity and how does it work?

What are various features of a Variable Annuity?

What are the fees, expenses, and charges associated with an annuity?

What are the tax benefits of a Variable Annuity?

What is an excellent checklist to consider before purchasing a Variable Annuity?

Who should buy a Variable Annuity?

How to evaluate a Variable Annuity?

Before we dig deep into the inner workings of variable annuities, we should first address some foundational concepts:

[ps2id id=’link1′ target=”/]

What is an Annuity?

Worthune’s plain English definition of an Annuity: An annuity is a contract between an investor and an insurance company where the investor purchases a stream of period-certain or lifetime income, starting now or starting later, by paying for the contract with a one-time lump sum, or in installments.

Now, let’s unpack the definition of an annuity a little bit.

- An annuity is a contract between an individual and an insurance company. (Hence, the stability and financial strength of the insurance company is a critical factor.)

- The insurance company guarantees a stream of income – whether it starts immediately or at a future date. (Sometimes, depending on the type of annuity, there is a provision to take a lumpsum withdrawal instead of annuitizing into a stream of income.)

- The income stream is typically for a lifetime, with some offering a minimum period-certain and also sometimes income for the life duration of a beneficiary. (The more bells and whistles the contract has regarding payout options and guarantees, the more likely there is a layering of additional fees and expenses.)

- Most annuity contracts have a death benefit provision. (In many cases, the cost of obtaining a separate insurance policy may be cheaper when all other things being equal.)

- The main feature of an annuity is a stream of income (subject to annuitization) that safeguards against longevity risk. (However, critics argue that lack of inflation protection diminishes the value of future income streams.)

Never use annuities inside retirement options. There is no sense paying the annuity fee to get a tax deferment that you already have in your retirement plan. Also avoid rolling over a retirement account into a VA. – Dave Ramsey

[ps2id id=’link2′ target=”/]

What are the different types of Annuities?

Broadly here are some basic types of annuities and their popular variations. Of course, an insurance company can tailor an annuity product with a variety of features, benefits, riders, and limitations.

Annuity Types based on underlying Investment Options:

Fixed Annuities: A fixed annuity is a contract in which an insurance company guarantees the principal and a specific rate of return. (The guarantee is not from a government entity, but the financial strength and stability of the firm.)

The payouts typically are either a fixed amount or a guaranteed rate (for a term) or a specific formula. T

Some insurance firms may pay a policy dividend – which is typically over and above the fixed rate – if the investment performance, expense profile, and mortality experience are favorable to the pool.

Most of the fixed annuities offer a death benefit guarantee where a beneficiary gets the annuity amount should the policyholder die prematurely.

Variable Annuities: A Variable Annuity is a part investment vehicle and part insurance vehicle where an investor’s premium payments into a variable annuity are invested into sub-accounts, which are like mutual funds, but available only to the policyholders. Typically, insurance companies offer several choices of subaccounts – (similar to what an employer may provide in a 401-k plan.)

The payouts in a variable annuity are dependent on the investment performance of the underlying subaccounts. So, choosing the right allocation to the sub-accounts is an essential factor which will drive the overall performance of the variable annuity.

A variable annuity can be an investment only or may include death benefits.

Index-Linked Annuities: An index-linked annuity is a combination of a fixed annuity, where there is a minimum guaranteed rate of return and a variable component that is tied to the performance of an index. Given the underlying guarantees and the fees/expenses, annuity holders do not fully participate in the upside of the index, but also do not fall below a particular floor, thus offering a safety net.

Annuity Types based on when Payouts begin:

Immediate Annuities: An immediate annuity is when the stream of income (or annuity payments) starts immediately after a year. With an immediate annuity, the policyholder is relying on the insurance company to pay his/her money in installments and over a more extended period.

Deferred Annuities: A deferred annuity is when the stream of annuity payments are set to begin a future date. Typically, most investors choose a post-retirement age to start the annuity payments to supplement and complement other retirement income sources.

Annuity Types based on how long Payouts Continue:

Lifetime Annuities: An annuity may be limited to the policy holder’s lifetime or continue to the life term of a beneficiary or a survivor. Of course, insurance firms use complex actuarial calculations to determine the joint survival, and payout rates and hence the payouts will be dependent on these life expectancy probabilities.

Period-Certain Annuities (or Fixed-Period Annuities): A period-certain or fixed-period annuities, as the name suggests, are for a for a fixed term. For example, a sweepstake or a lottery pays outs an annual stream for a set period – such as 20-years or 30-years.

(Please remember that most annuities offer some lumpsum withdrawal options.)

Annuity Types based on the number of Premiums:

Single Premium Annuities: In a single premium annuity, the policyholder pays a lump sum or one single premium to purchase an annuity – irrespective of whether it is an immediate or deferred annuity.

Flexible Premium Annuities: In a flexible premium annuity, a policyholder may pay into the annuity over a longer-period – either in regular installments or at a variable rate. The term of flexible payments is the accumulation period in an annuity. After the payments are complete, the annuitant has the choice to begin the income stream immediately or defer it to a future date.

Annuity Types based on Tax Status:

Qualified Annuities: Please remember that annuities are NOT a tax-qualified vehicle, but annuities offered as a part of qualified retirement plan retain some of the features of the container.

Non-Qualified Annuities: These are general annuities purchased in the open market from an insurance company, and often through an agent (or financial advisor).

With these broad categories and the addition of other bells and whistles, an insurance company can design unlimited variations of the annuity products.

“There is a magical, secret ingredient, a secret sauce, inside an annuity that can’t be replicated in any conventional financial product or synthesized by traditional money managers. I’m a big fan of annuities that behave like pensions,” – Moshe Milevsky.

[ps2id id=’link3′ target=”/]

What is a Variable Annuity and how does it work?

A variable annuity is a contract between an insurance company and a policyholder where the annuitization benefits are tied to the performance of the underlying sub-accounts. A variable annuity is partially an insurance contract and partly a security and hence both the SEC (Securities and Exchange Commission) and the State Insurance Departments regulate the contracts.

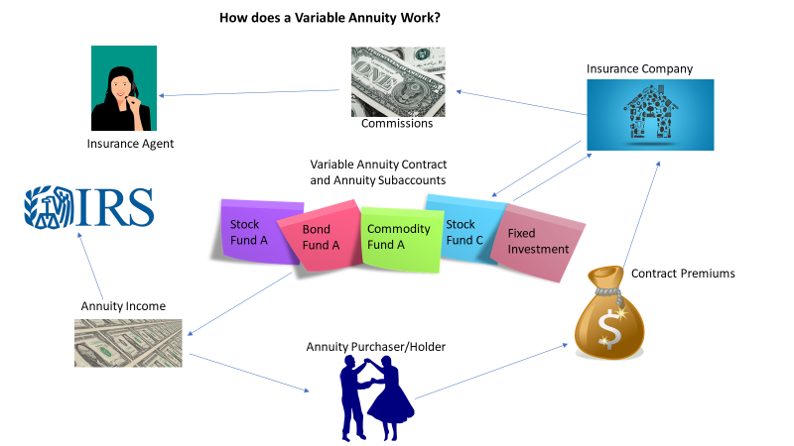

Simple process steps of how a Variable Annuity works:

- The investor/policyholder purchases a variable annuity from an insurance company with the help of an insurance agent or a financial advisor (As variable annuities are securities, appropriate licensing is mandatory for the insurance agent or the registered rep.)

- The investor/policyholder selects the contract amount, the amount and frequency of payments, and the timing of the payout.

- The investor selects the allocation to underlying sub accounts. (Subaccounts in variable annuities are similar to mutual funds.) Insurance companies allow the investors to modify the distribution and rebalance the underlying sub-account portfolio after some time elapses (either monthly, quarterly or annually.)

- The money in the account grows on a tax-deferred basis. The investor may move cash within subaccounts tax-free.

- The insurance company administers and manages the variable annuity contract based on the agreed upon terms. The insurance company is responsible for investing the premiums into the investment options the policyholder selects, and manage all the back office functions such as portfolio accounting, performance measurement, actuarial calculations, fees and expenses, commission payments to the insurance agents, and billing. The insurer is also responsible for payouts – either in a lump sum or a stream of payments through annuitization.

- The variable annuity contract holder receives the proceeds, based on market performance (minus fees, expenses, and charges) either a lump sum or the ability to annuitize the contract into a stream of future payments.

- At a certain age, there may be forced annuitization provision thus forcing the policyholder to receive payouts.

[ps2id id=’link4′ target=”/]

What are various features of a Variable Annuity?

A variable annuity is a complex instrument, and it is essential to understand the intricacies before making an investment decision.

Variable Annuity Feature List:

Various Sub Accounts or Investment Options:

Variable annuities investment options have become diverse and sophisticated over the last decade. Today, variable annuities offer plain vanilla mutual fund type options to extremely complex alternative investment options. (Typically, the IOVA (Investment Only Variable Annuities) is a container for such complex alternative investments or illiquid assets. Since these may be valuable to an HNW (high net worth) family, we will address the concept of IOVA separately.)

The investment options span multiple asset classes such as stock funds, bond funds, commodity funds, money market instruments. Within stock funds, the choices include different styles such as value funds, and growth funds; different asset classes like large cap, small cap, mid-cap, and international; and management options such as actively managed funds, index funds, and ETFs. Same is the case with bond funds such funds that invest in government bonds and agency securities, municipalities, corporate debt, distressed debt, sovereign debt, etc.

Almost all annuities include one or more Fixed Investment option which offers a guaranteed rate. Typically, the guaranteed rate is for a specific term – one or more years – after which it resets. If an investor moves or withdraws money from a fixed account, during the guarantee term, it may involve a complicated market value adjustment based on prevailing interest rates.

All internal transfers between sub-accounts are tax-free.

Tax-Deferred Growth:

A variable annuity is a shelter from ongoing taxation as the earnings within an annuity grows tax-deferred. What it means is within an annuity any income, dividends, or capital gains are not subject to immediate taxation – unlike in a non-qualified brokerage account.

However, non-qualified variable annuity proceeds, which are over and above the principal, are subject to taxation as ordinary income. This is because, in a non-qualified variable annuity, an investor is investing after-tax dollars.

The technical term of how much of annuity income stream is subject to taxation is dependent on the “Exclusion” ratio, which determines which is an original investment and what is growth.

In a qualified variable annuity – as in the variable annuity option as a part of qualified retirement plans like 401-k et al. – the entire proceeds are taxable as all the money in the account has never been subject to tax.

Death Benefit:

The death benefit feature of a variable annuity is unique as well as a controversial feature. A variable annuity pays out the contract value at the time of death to one or more beneficiaries. A standard death benefit typically pays out the higher return of premium minus any withdrawals, or the current contract value.

Also, an annuitant may choose enhanced death benefits, for an extra charge, of course. Each of these add-ons is of different flavors. Some enhanced death benefits lock in the contract value periodically, lest an annuitant dies at the low point of the contract value. Some other contracts offer a minimum rate of return. Another enhanced death benefit provides a step-up in earnings to offset potential taxation at the beneficiary level.

Living Benefits: Living benefits are also an enhancement over the plain vanilla variable annuity. The living benefits include:

A guaranteed minimum accumulation which assures a specific contract value irrespective of the market performance of subaccounts.

A guaranteed minimum income benefit which provides a lifetime income stream and the insured amount is a rather complex set of options and calculations.

A guaranteed withdrawal benefit allows withdrawal of purchase premiums over a specific period or lifetime.

Lifetime Income Streams:

Lifetime income is a feature of annuities (including variable annuities) that guarantees a payment throughout the life of the annuitant and in some cases the lifetime of the beneficiary as well.

Spousal Continuation:

Some variable annuities offer the spouse of the deceased annuity holder to continue with the contract and often at a higher contract value or death benefit. This postpones the taxable events to a later date for the surviving beneficiary.

[ps2id id=’link5′ target=”/]

What are the fees, expenses, and charges associated with variable annuities?

Variable annuities are expensive with a multitude of fees, expenses, and charges. Investors must pay attention to the overall cost of ownership and also determine whether the optional features are worth the expense in their case. The impact of even a few basis points over a long period on a massive investment can be quite substantial.

Surrender Charges: Surrender charges are indirect sales loads to compensate the sales force – the insurance agents and financial planners/brokers. The insurance company will charge a surrender fee anytime before the end of the lockup period – usually 5-7 years, but often as long as ten years. The surrender charge reduces progressively as the contract life matures and the surrender period elapses.

Insurance Premiums or Mortality and Expense Risk Fee: Mortality and Expense fee is for the insurance benefit (death benefit guarantee) and is a percentage of the account value. The M/E expense ratio is somewhere between 1.00-1.5% and allows the insurance companies to defray the mortality risk of the underlying annuity holder population and also pay incentives and commissions to the sales force. (Critics of annuities argue that buying term life insurance and investing the corpus into a non-qualified brokerage account may be cheaper.) Of course, there are other benefits that an investor may value over the incremental cost – such as tax deferral and a steady stream of income payments.

Underlying Sub Account or Fund Management Fee: As discussed before, a variable annuity has several underlying investment options – the subaccounts or funds –, and each has an associated management fee. This fee is similar to what you pay in a mutual fund and varies based on whether it is actively managed or a passive index fund or a PDF.

Administrative Fees: Some insurers may charge an administrative fee for providing the recordkeeping and other services. The administrative fee may be fixed annual fee or a variable fee as a percentage of the variable annuity account value.

Other Optional Fees: There are a lot of riders, features, and benefits that one can layer on to a variable annuity and all these incur an additional fee. Investors must weigh the benefits carefully. For example, features such as enhanced death benefits, spousal continuation, guaranteed minimum account value, or guaranteed minimum income add to the cost of ownership of an annuity.

Indeed, the variable annuities are complex and have a lot of costs and fees. However, Worthune team believes transparency in the fee schedule and awareness of cost and benefit goes a long way in helping investors make the right call about a variable annuity is right for them.

[ps2id id=’link6′ target=”/]

What are the tax benefits of a Variable Annuity?

A variable annuity is NOT a qualified investment vehicle such as a 401-k. However, variable annuities do offer some valuable tax benefits, particularly for wealthy investors. The following tax features apply to the more traditional non-qualified annuities.

Tax Deferral: The money in a variable annuity grow on a tax-deferred basis. That is an investor does not pay ongoing annual taxes on dividends, income, short and long-term gains which accrue in the annuity subaccounts.

For example, if you have $10,000 in a variable annuity and for the tax year 2018, you receive $800 in overall growth (dividends, income, short and long-term gains in subaccounts.). Usually, in a non-qualified brokerage account, you’d pay ordinary income taxes and long-term capital gains on the growth. However, in a variable annuity, this amount is not taxable on an annual basis and taxes are deferred until the payouts commence.

Tax Fee Transfers: Assuming the variable annuity has several fund choices and you’ve invested in several different options. The movement between these accounts for adjusting your asset allocation and rebalancing your positions will be tax-free. This feature can be an essential advantage if an investor relies on asset allocation and rebalancing within the variable annuity subaccounts.

1035 Exchange: A variable annuity also benefits from an IRS code feature – the Section 1035. The IRS provision permits the direct exchange of a non-qualified variable annuity for another non-qualified variable annuity without any current or future tax consequences. For some investors, a trade may be suitable when a contract is older and does not provide current features some of which may be important. However, it will be critical to examine the consequences such as surrender charge and fee/expenses before making such a decision.

Exclusion Ratio on Income Payouts: As premiums/investments into a non-qualified variable annuity are with after-tax dollars, when the annuitization commences, there is an exclusion amount on which the annuitant does not pay taxes. Suffice it to say that while the insurers engage in intricate calculations, it is the amount that an investor has contributed to the contract will generally be considered the exclusion ratio.

As for annuities offered as a part of a qualified plan, the money goes in pre-tax and hence all the income is taxable as personal income, even as the tax deferral, tax-free transfers, and other benefits remain.

[ps2id id=’link7′ target=”/]

What is an excellent checklist to consider before purchasing a Variable Annuity?

Here are a checklist and questions to ask yourself and the insurance agent before purchasing a variable annuity contract:

- What are your investment goals and financial planning objectives? Is it retirement income or current tax deferral or a combination thereof?

- What is your time horizon? Is the time span longer than 7-years? Preferably 10, 20, or 30 years? (The time horizon should at the minimum be longer than the period until after the surrender charge expires.)

- Do you have sufficient other liquid assets to fall back on in case you need cash for other goals?

- Have you taken advantage of other tax-qualified and tax-deferred options before purchasing a variable annuity?

- Are you willing to take the risk of your subaccount values decreasing due to market conditions?

- Have you consulted your tax, legal, and financial/insurance advisors to determine the right course of action and the appropriate variable annuity strategy?

- Did you evaluate all the features and done cost/benefit analysis?

- Do you understand the tax benefits and consequences?

- Do you understand the fees, expenses, charges and lockup periods?

- Do you have enough years regarding life expectancy for an annuity to make sense?

- Do you understand the financial motivations of your insurance agent/financial advisor and how much compensation they receive?

- Have you done some comparison shopping to evaluate variable annuity offerings from multiple providers?

[ps2id id=’link8′ target=”/]

Who should buy a Variable Annuity?

In most cases, “Annuities are sold, not necessarily bought.” This sometimes means those who probably should not buy end up in variable annuities. Ideally, an investor should ask insightful questions and gather sufficient research and make a decision. While it is not set in stone, our team at Worthune thinks the following are ideal characteristics for buying an annuity.

A person has sufficient liquidity and has maximized qualified plan contributions.

The investor is in a high tax bracket presently, and tax-deferral would help alleviate the situation. And the expectation is for a lower tax bracket during retirement.

The time horizon should be more than 10-years at a minimum and possibly more.

The investor is sophisticated and understands the nuances of how investment and insurance products work.

[ps2id id=’link9′ target=”/]

How to evaluate a Variable Annuity?

Compare at least three to five offerings from different providers with regards to:

Variable Annuity Contract Provisions:

Investment options

Surrender charges

Death benefit and other related riders

Mortality and Expense Ratio

Administrative fee

Underlying fund management expenses

Additional costs and fees

Insurer Viability:

Insurer financial strength and stability

Loss Ratios and Reserves

Investment Performance

Insurer Ratings – Companies like Standard and Poors, Fitch, AM Best, Moody’s rate insurance companies and are an excellent place to start.

Disclaimer: The Ultimate Variable Annuity Guide is for informational purposes only. Worthune is not a financial advisor or an insurance agent. We do not provide insurance, financial planning, tax, or legal advice. Please consult your attorney, accountant, insurance agent or financial advisor for specific recommendations in your case. While we strive to provide accurate information some of the data here may be outdated.

Leave A Comment