Many financial planners go to extreme lengths and in the bargain subject their clients to considerable pain while creating the precise or perfect financial plans. The intentions are noble, the approach sounds reasonable, the calculations are accurate, and the inputs are painstakingly detailed, but the challenges are in assumptions and the dynamic nature of life. Even the best financial plans are a point in time snapshot and generally are wrong 10-15-20 years from now. It seems the striving for precision in financial planning is an exercise in futility.

But why do it? And is there a better way? Please Read on. |

In this post, we will examine the myth of the perfect financial plan, the reasons why financial advisors engage in it, and potential rewards/blindspots from such a watertight financial plan.

Dispelling the Myth of Perfect Financial Plans:

Assumptions:

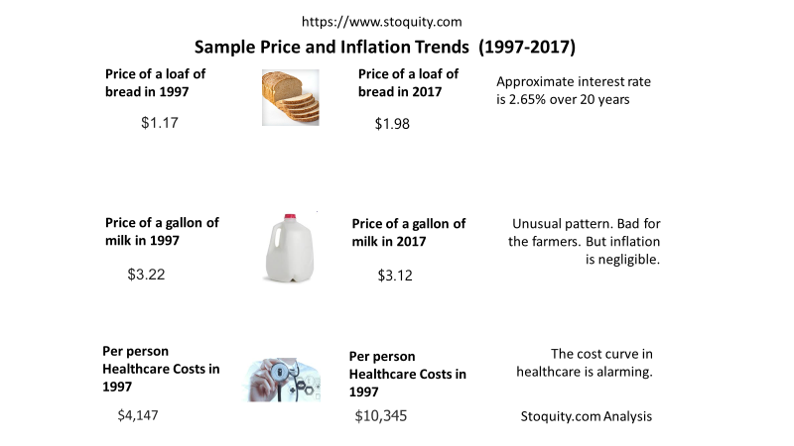

Inflation: Inflation is something that can scare the pants of people or make them complacent. There are multiple reasons for inflation assumptions becoming a burden on planning assumptions. Typically, our inflation expectations are clouded by the present circumstances. If we were planning in the eighties, 10% inflation assumption to model future costs would be seen appropriate. Today, in the low inflation environment, even 4% would seem rather high. And while in some sectors the inflation is spiraling out of control – take higher education and healthcare – there may be a breaking point at some stage when the cost curve cannot sustain, and there may be a reversion to equilibrium.

Inflation: Inflation is something that can scare the pants of people or make them complacent. There are multiple reasons for inflation assumptions becoming a burden on planning assumptions. Typically, our inflation expectations are clouded by the present circumstances. If we were planning in the eighties, 10% inflation assumption to model future costs would be seen appropriate. Today, in the low inflation environment, even 4% would seem rather high. And while in some sectors the inflation is spiraling out of control – take higher education and healthcare – there may be a breaking point at some stage when the cost curve cannot sustain, and there may be a reversion to equilibrium.

Income Growth: Another assumption that makes the financial plan go awry is the linear income growth. For example, a general assumption for a 40-year couple with household income of $250,000 is a 2% or 3% income growth. There is nothing wrong with this assumption per se, but what it does not account for is prospects for job functions/skills and the industry sector. In its heyday, workers at Eastman Kodak would not be wrong to expect the gravy train to continue. Or the executives at the modern day retailers upended by the e-commerce revolution. We admit financial advisors are not fortune tellers and one cannot expect them to model the vagaries of the ups and downs of the general industries/sectors, let alone the future fate of specific companies.

Black Swan Events: By definition, black swan events are one-off, severe, and unpredictable. Given that in one’s lifetime, that there will be multiple black swan events is a safe assumption, but there is no way to model the magnitude of the event, and the impact on the finances. For example, if a black swan event happened at the early stage of one’s financial life, it may be relatively more straightforward to recover but imagine the horror of a just-retired couple who may have faced the Black Friday in October 1987 or the Great Recession of 2009. Again, this is not a flaw of financial planners, but the sheer vagaries of how these things work.

Black Swan Events: By definition, black swan events are one-off, severe, and unpredictable. Given that in one’s lifetime, that there will be multiple black swan events is a safe assumption, but there is no way to model the magnitude of the event, and the impact on the finances. For example, if a black swan event happened at the early stage of one’s financial life, it may be relatively more straightforward to recover but imagine the horror of a just-retired couple who may have faced the Black Friday in October 1987 or the Great Recession of 2009. Again, this is not a flaw of financial planners, but the sheer vagaries of how these things work.

It’s OK to have a plan, to invest in your future – for your financial security, your love life, your personal fulfillment, and even your happiness. To have personal happiness as a stated goal doesn’t detract from it if you get there. – Karen Finerman

Tax Rates: Tax rates are at the vagaries of the party in power at the federal, state, and local levels. Whether they are progressive or regressive taxes, the overall composition and the load on an average person is difficult to determine. For example, millions save billions into tax-deferred vehicles. Imagine what will happen if there were to be means-testing and a tax above a certain threshold. So, it is impossible to determine the specific rates and the impact on the post-retirement years.

Insurance: When a wealth planner or an insurance advisor does a life insurance illustration, the assumption is that the insured will die tomorrow, irrespective of the age and health status. And for long-term care, it is assumed someone may go into a care facility and stay there for 5 or more years. (Of course, this is the right risk management strategy.) The challenge is if a spouse is on the younger side, the financial and marital circumstances may (and most certainly in many cases) change after the insured dies. So the question is whether the support should be planned for the lifetime (or retirement) of the surviving spouse? Should the amount of insurance be based on current income and wealth or expected growth and aspirational lifestyle? For example, if a physician couple in private practice at the beginning of their career were to consider life insurance, should it be based on the small income of a resident? Or the high-flying plastic surgeons they have trained to be? There is no easy way to do this. The only thing we are trying to point is the futility of achieving precision and being perfect with numbers to the last decimal. Perfect financial plans are a myth.

Insurance: When a wealth planner or an insurance advisor does a life insurance illustration, the assumption is that the insured will die tomorrow, irrespective of the age and health status. And for long-term care, it is assumed someone may go into a care facility and stay there for 5 or more years. (Of course, this is the right risk management strategy.) The challenge is if a spouse is on the younger side, the financial and marital circumstances may (and most certainly in many cases) change after the insured dies. So the question is whether the support should be planned for the lifetime (or retirement) of the surviving spouse? Should the amount of insurance be based on current income and wealth or expected growth and aspirational lifestyle? For example, if a physician couple in private practice at the beginning of their career were to consider life insurance, should it be based on the small income of a resident? Or the high-flying plastic surgeons they have trained to be? There is no easy way to do this. The only thing we are trying to point is the futility of achieving precision and being perfect with numbers to the last decimal. Perfect financial plans are a myth.

Why do advisors strive for such Precision and Perfection?

The Desire to be Precise: Financial planning at its heart is an art with some science thrown in. But, some financial advisors take the concepts of financial planning to the illogical end. For example, some advisors give a worksheet to their clients to fill out itemized expenses numbering over a hundred categories. Is that really required? Of course, it may help when the costs are out of the whack, and the clients are either debt-ridden or unable to save. But for affluent families putting out the specific weekly grocery bill may not be that helpful. We think the idea of telling someone, “You will spend “$ 8,294.43″ a week” in weekly groceries by 2040 feels a lot better than saying, “Well, your general expenses on groceries may exceed $7500 based on the today’s ballpark expense estimates.”

Shortfalls are a source of Product sales: Believe it or not, even for fee-only financial planners, at the end of the day, the AUM (Assets under management) matters as that is the basis for compensation. And there are still many other financial representatives, insurance agents, brokers who depend on commission. An insurance shortfall of $2,000,000 will scare the living daylights of clients and make them plunge for expensive insurance, whereas in most cases, a fixed-term policy may do the trick. (We are the first ones to admit a majority of the advisors have their clients’ best interest at heart and don’t do anything that is unethical, illegal, or unnecessary.)

Clients’ Expectations: When a couple walks into a financial planner’s office, they always look for specific and precise answers. “Well, something between $500-800k in life insurance may suffice based on your situation,” is much less compelling than an illustration showing $989,658.23″ in a shortfall.

There is no other way: Truth be told, even if the financial planners realize the myth of perfect financial plans and precise numbers, there is not another objective way to do this work. Subjectivity may be questioned in court, and they may be subject to litigation and lawsuits. A rule of thumb may not stand the strict scrutiny of a litigious client and his/her attorney. Precise numbers are in one way an insurance against future problems and a valid CYA (Cover Your Ass) strategy.

What should the Clients’ do?

- Guesstimates: Take it for what the financial plan is all about. It is an estimate, based on certain assumptions, and crystal ball gazing into an uncertain future. Do not deem the numbers are cast in iron and inviolable. Vary your estimates. Good financial planners are always willing to produce “What-If” scenarios.

- Spin the Ball: Wherever possible, request your planners/advisors to use probabilistic methods (such as Monte Carlo Simulation), rather than straight line, deterministic calculations.

- Predicting the Future is Tough: For things like inflation, interest rates, stock market gains, remember the concepts of business cycles, the natural ebbs and flows, and of course black swan events. Remember there are many things you don’t control. Your job is not just about your performance. Your 401-k is not about how well you have done your asset allocation. Whether it is natural disasters or human-made cataclysmic events, the world is volatile and will impact your financial lives.

- Be Flexible: You can’t plan for everything and what you plan can never be spot on. So, be willing to be flexible, dynamically altering the assumptions as years go by, and adjust your financial planning methodology to the evolving circumstances. For example, do you really need a second home on the Malibu coast? Or would you be willing to compromise on another beach location that is nice and warm? Or for example, what if your company took off and you sold it for a gazillion dollars? Well, you may up the ante and think of how a Gulf Stream may fit in with your future retirement travel plans.

- Be Revocable: Try not to cast things that are set in stone and cannot be easily undone. (There are some benefits to things that are irrevocable, such as insurance trusts. Or deferred compensation plans. Or qualified accounts like an IRA. Please talk to your advisor tri0 – wealth advisor, CPA, and an Estate planning attorney about which of these, if any, are relevant to your situation.) However, things in the future are not easily predictable – such as whether the junior will still be a part of your 20-years from now estate plan. Or whether you will sour on your alma mater consistently producing subpar sports teams. The ability to postpone decisions for a point in time offers excellent flexibility and circumstance based decision-making.

- Track but not Watch: Keeping track of your wealth is strongly recommended. However, there is a difference between watching paint getting dry or blades of grass grow – every minute. Live life. Keep an eye, but not your entire focus, all day and all night, each and every day.

Is your financial planner known to craft Perfect Financial Plans? If so, what has been your approach to the numbers?

Leave A Comment